Become a Payment Service Provider with Our Payout Payment Software

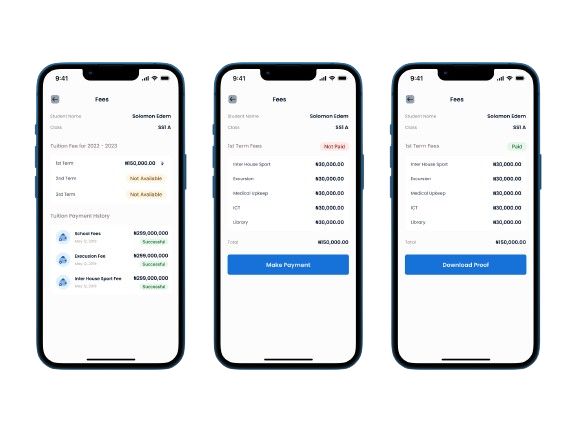

WaayuPay offers a powerful Payment platform designed to make your payment transaction services hassle-free, without the need to build processing and payment gateway software from scratch. Provide a comprehensive suite of online payment processing services for merchants, enabling them to accept payments seamlessly—from online transactions.

Contact Us